Navigating the intricacies of tax filing is paramount for every taxpayer. A crucial aspect of this process is being aware of the deadlines for filing updated Income Tax Returns (ITRs). The provision for updating an ITR allows taxpayers to make amendments or declare previously unreported income after the original deadline has passed. Below, we detail the deadlines for updated ITR filings for three recent financial years.

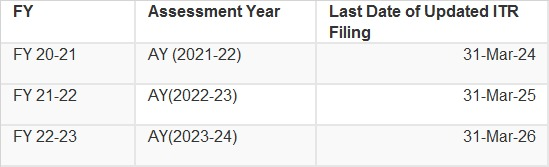

Updated ITR Filing Deadlines Overview:

- For FY 2020-2021 (Assessment Year 2021-2022): The last date to file your updated ITR was 31st March 2024. This window provided taxpayers ample time to reassess their filings and make necessary amendments to ensure accuracy and compliance.

- For FY 2021-2022 (Assessment Year 2022-2023): Taxpayers have until 31st March 2025 to submit their updated ITRs. This allows for corrections or additional declarations of income that may have been overlooked in the initial filing.

- For FY 2022-2023 (Assessment Year 2023-2024): The deadline for filing updated ITRs extends to 31st March 2026. This timeframe is intended to accommodate taxpayers wishing to rectify any discrepancies or update their returns with new information.

The Importance of Updated ITR Filing

The option to file an updated ITR is a valuable tool for maintaining tax compliance and ensuring that all income and deductions are accurately reported. It helps taxpayers avoid penalties for misreporting or underreporting income in their original tax returns. By staying informed of the deadlines, taxpayers can take proactive steps to rectify their tax filings and remain in good standing with tax authorities.

Key Takeaways

- The process for updated ITR filing is an essential aspect of tax compliance, allowing taxpayers to correct errors or omissions after the original due date.

- Familiarizing yourself with the specific deadlines for each financial year is crucial to taking advantage of this opportunity.

- It’s advisable for taxpayers to review their tax returns within these periods and consult with tax professionals if they need to make updates or corrections.

This guide aims to keep you informed about critical deadlines for updated ITR filings, ensuring that you remain compliant and avoid potential penalties. For more detailed guidance and tax assistance, consider reaching out to a tax professional.