The Union Government’s recent move to allocate a India’s Tax Devolution of ₹1,73,030 crore to State Governments in January 2025 marks a pivotal shift in fiscal planning. This allocation reflects a 94% increase from December 2024’s ₹89,086 crore, underscoring the Centre’s commitment to strengthening state finances for capital expenditure and welfare-driven initiatives.

Why the Surge in Tax Devolution?

The government’s decision to nearly double the tax devolution this month stems from:

- Capital Spending Acceleration: Ensuring states have ample resources to bolster infrastructure projects.

- Welfare Funding: Providing adequate funds for ongoing development and social welfare schemes.

- Strategic Fiscal Planning: Offering additional fiscal flexibility to address state-specific challenges efficiently.

This surge in devolution aligns with India’s broader economic goals, focusing on inclusive growth and fostering state-level autonomy.

Historical Context: A Pattern of Timely Support

In recent months, the Union Government has consistently advanced state funding to address financial bottlenecks. For instance:

- December 2023: An additional ₹72,961 crore was released to enhance state capacities for welfare and infrastructure initiatives.

- October 2024: Over ₹1.78 lakh crore was allocated, effectively doubling the usual monthly disbursement.

Such proactive fiscal measures underscore the government’s focus on enabling states to fulfill both developmental and welfare objectives seamlessly.

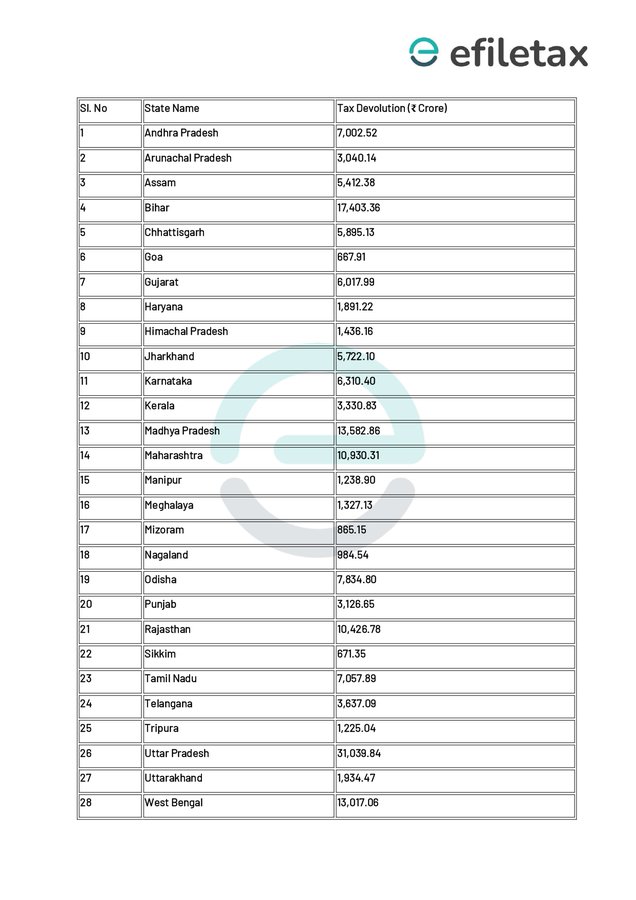

State-Wise Allocation: A Closer Look

The January 2025 tax devolution includes specific allocations tailored to each state’s requirements. The following table provides a comprehensive overview of the state-wise distribution:

| State | Amount (₹ Crore) |

|---|---|

| Andhra Pradesh | 7,002.52 |

| Bihar | 17,403.36 |

| Uttar Pradesh | 31,039.84 |

| Maharashtra | 10,930.31 |

| Tamil Nadu | 7,057.89 |

| West Bengal | 13,017.06 |

| Rajasthan | 10,426.78 |

| Others | Varies |

For a full breakdown, refer to the detailed government release.

Implications for State Economies

The enhanced tax devolution impacts states in the following ways:

- Infrastructure Growth: Greater investments in roads, healthcare, and education.

- Welfare Program Continuity: Strengthening social schemes targeting vulnerable populations.

- Fiscal Stability: Reducing dependency on market borrowings.

Relevant Case Laws & Fiscal Precedents

In previous rulings such as State of Karnataka v. Union of India (2023), courts emphasized the necessity of equitable fiscal transfers to ensure balanced regional development. The January 2025 devolution adheres to these principles, enabling states to meet their constitutional obligations effectively.

What Lies Ahead?

The substantial tax devolution reinforces India’s commitment to cooperative federalism. With enhanced fiscal resources, states can prioritize high-impact projects and ensure robust economic recovery post-pandemic.

For more insights into tax policies and updates, explore our curated guides at efiletax