Govt Confirms SGB Reserve Coverage: Key Relief for Investors

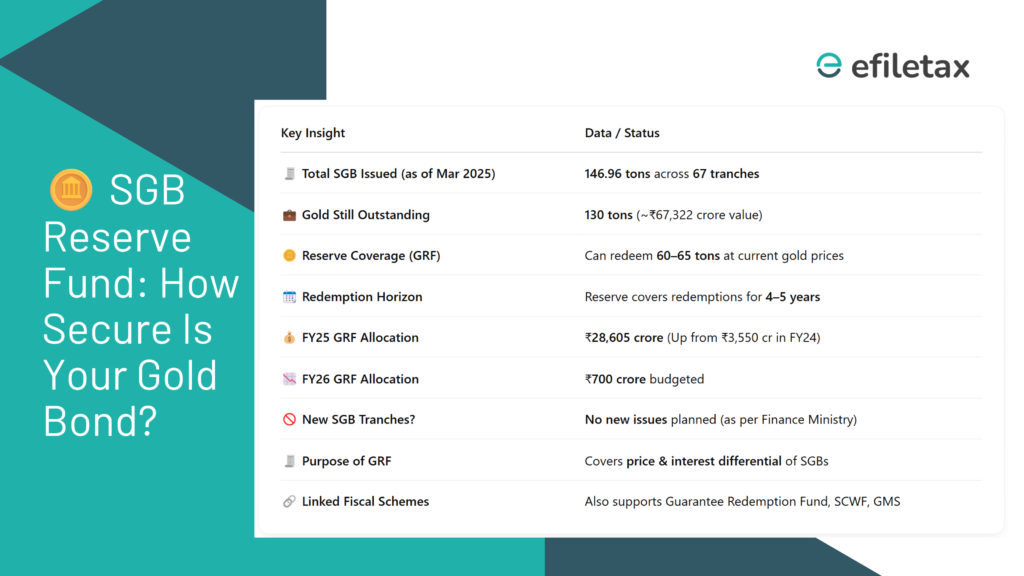

Nearly half of all outstanding Sovereign Gold Bonds (SGBs) are now backed by actual government reserves, offering critical confidence to investors ahead of large-scale redemptions.

As of March 20, 2025, 130 tons of gold remain outstanding under SGBs. The Gold Reserve Fund (GRF) can cover 60–65 tons, equivalent to ₹67,000+ crore in value — thanks to a sharp rise in FY25 budget allocation.

🧾 Quick Snapshot: SGB Issuance & Reserve Position

| Metric | Figure |

|---|---|

| Total SGB Tranches Issued | 67 |

| Gold Issued (Cumulative) | 146.96 tons |

| Outstanding SGBs (as of Mar 2025) | 130 tons |

| GRF Reserve Coverage | 60–65 tons |

| SGB Value at Current Price | ₹67,322 crore |

| FY25 GRF Allocation | ₹28,605 crore |

| FY24 GRF Allocation | ₹3,550 crore |

| FY26 GRF (Projected) | ~₹700 crore |

🛡️ What Is the Gold Reserve Fund (GRF)?

The GRF is a fiscal cushion created to manage:

- Redemption payouts on matured SGBs

- Price volatility in global gold rates

- Interest payments and differential adjustments

It forms part of the larger sovereign obligation framework, which also includes:

- Senior Citizen Welfare Fund

- Guarantee Redemption Fund

- Gold Monetisation Scheme

🔍 What This Means for SGB Investors

✅ Redemption Stability: Investors due for redemption in the next 4–5 years are fully covered.

✅ Price Assurance: Even if gold prices fluctuate, GRF ensures payouts are unaffected.

✅ Trust Boost: Signals long-term commitment by the government to honour all dues.

🧭 Is This the End of New SGBs?

The Finance Ministry has hinted that no new SGB tranches will be issued going forward. This increases the scarcity and premium appeal of existing bonds, especially for long-term holders.

If you hold bonds from 2015–2020 series, redemptions begin this fiscal year. You’ll receive:

- Prevailing market gold value (₹/gm)

- 2.5% annual interest payout till maturity

SGB reserve now covers 60–65 tons of outstanding gold bonds, securing redemptions for 4–5 years. Learn what this means for investors.

❓FAQs

Q1. Will my SGB be redeemed safely after maturity?

👉 Yes. Government reserves now cover up to 65 tons, covering most redemptions due till 2030.

Q2. Can I still buy new SGBs?

👉 Not at present. The Finance Ministry has paused fresh tranches.

Q3. What return do I get on redemption?

👉 You’ll receive the average gold price of last 3 business days, plus 2.5% interest per annum (credited semi-annually).