SEBI to Restrict F&O Trading: Investor Eligibility Reforms

The Securities and Exchange Board of India (SEBI) is considering significant changes to the futures and options (F&O) trading landscape in an effort to protect retail investors. With increasing concerns about the risks involved in F&O trading, the regulator is exploring the idea of introducing eligibility criteria for retail investors, which could effectively restrict this market to accredited investors only. Such measures are aimed at ensuring that only those with a thorough understanding and adequate risk-bearing capacity participate in this volatile segment of the equities market.

What Prompted SEBI to Consider Investor Restrictions?

The F&O market has been known for its high-risk, high-reward potential. However, recent data suggests that retail investors have faced significant losses, raising red flags for regulators. According to a study conducted by SEBI, a staggering 91.1% of individual F&O traders lost money in FY24, with aggregate losses exceeding ₹ 1.8 lakh crore over the last three years. This data highlights the substantial risks involved in F&O trading, prompting SEBI to explore ways to better protect small investors.

The study further found that 93% of individual traders incurred average losses of ₹ 2 lakh per trader from FY22 to FY24. Moreover, 4 lakh traders faced an average loss of ₹ 28 lakh per person during this period. With only 1% of individual traders managing to earn profits exceeding ₹ 1 lakh from FY22-24, it’s clear that the majority of retail investors have been on the losing side of F&O trading.

The Proposed Accredited investor F&O

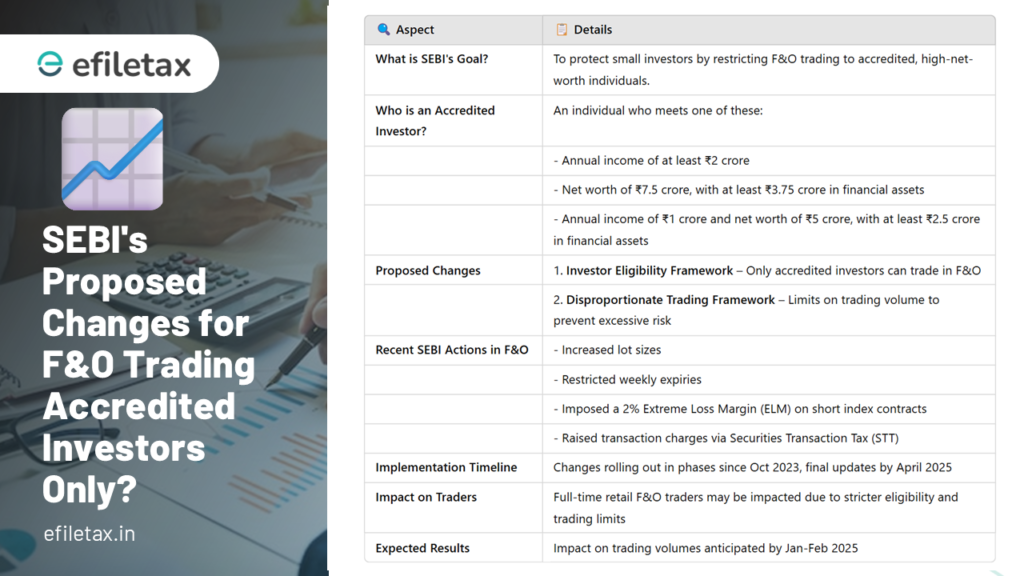

In light of these alarming statistics, SEBI is considering implementing an accredited investor model similar to that used for Alternative Investment Funds (AIFs). Under this model, only individuals who meet certain financial criteria would be allowed to participate in F&O trading. This step is intended to ensure that only those who have the financial resources and knowledge to handle the risks involved can trade in this segment.

According to Sriram Krishnan, Chief Business Development Officer at NSE, SEBI has already made some changes to restrict F&O trading and is now considering further reforms to introduce investor eligibility requirements. These requirements would be akin to those for investments in hedge funds, private equity, and AIFs, where investors need to meet specific net worth and income criteria.

For example, to qualify as an accredited investor for F&O trading, individuals may need to meet one of the following criteria:

- An annual income of at least ₹ 2 crore

- A net worth of at least ₹ 7.5 crore, with at least ₹ 3.75 crore in financial assets

- An annual income of at least ₹ 1 crore and a net worth of at least ₹ 5 crore, with at least ₹ 2.5 crore in financial assets

These stringent criteria are intended to ensure that only those with sufficient financial capacity, experience, and understanding of the market participate in F&O trading, thereby reducing the exposure of retail investors to significant losses.

Recent Measures to Curb High-Risk F&O Trading

SEBI has already implemented a series of measures aimed at curbing high-volume trading in the F&O segment. These measures include:

- Increasing the lot size of contracts by up to three times

- Restricting weekly expiries to a single contract

- Levying an Extreme Loss Margin (ELM) of 2% on short index contracts

- Raising transaction charges through an increase in the Securities Transaction Tax (STT)

These changes, which are being implemented in phases, are intended to limit speculative trading and reduce the systemic risk posed by the F&O segment. The final phase of these changes is expected to be completed by April 1, 2025.

NSE’s Stance on Investor Protection

In a recent interaction, Sriram Krishnan emphasized the need for more stringent investor protection in the F&O market. He advocated for the introduction of an accredited investor model and the establishment of a disproportionate trading framework to define how much one can trade based on their financial capability. According to Krishnan, these steps would help protect retail investors from overexposure and mitigate the risks of significant financial loss.

The National Stock Exchange (NSE), being one of the largest equity exchanges in India, has been working closely with SEBI to implement these measures. The focus is on ensuring that investors are well-informed and capable of handling the financial risks associated with F&O trading.

Impact on Retail Investors

The proposed changes by SEBI could have a far-reaching impact on retail investors in India. By limiting F&O trading to accredited investors, SEBI aims to protect smaller investors from significant losses. However, this also means that a large section of retail investors who currently participate in the F&O market may no longer be eligible to trade in this segment. This move is seen as a way to shift the focus of retail investors towards less risky investment options, such as mutual funds or other equity instruments.

The F&O market has always been a high-risk trading avenue, but recent data from SEBI has shown the stark reality faced by retail investors—with more than 91% of traders incurring losses. To curb these losses and ensure that only those with the financial capability participate, SEBI is considering introducing an accredited investor model. The goal is to protect small investors from the risks associated with leveraged trading and ensure that the F&O market remains a place for informed and financially capable participants.

While these changes may restrict access for some, they are aimed at promoting responsible trading practices and maintaining the overall stability of the market. If you are currently participating in F&O trading or are considering it, be sure to stay updated on these regulatory changes and assess whether you meet the upcoming eligibility requirements.

Some content is sourced from here

SEBI’s Accredited investor F&O

| Aspect | Details |

|---|---|

| Eligibility Criteria | Accredited investors only |

| Income Requirement | Annual income of at least ₹ 2 crore |

| Net Worth Requirement | Net worth of ₹ 7.5 crore (₹ 3.75 crore in financial assets) or ₹ 5 crore (₹ 2.5 crore in financial assets with income of ₹ 1 crore) |

| Recent Measures | Increased lot sizes, restricted weekly expiries, 2% ELM on short contracts, higher STT |

| Implementation Timeline | Final phase by April 1, 2025 |

| Impact on Retail Investors | Limited access to F&O for retail investors; focus on safer alternatives like mutual funds |

| Goal | Protect retail investors and promote responsible trading practices |

If you need help navigating these changes or understanding how they might affect your Tax, contact us at efiletax for professional advice and support.