A Private Limited Company (PLC) in India is a favored business structure, particularly for startups and small to medium-sized enterprises (SMEs). It offers an ideal blend of limited liability, structured governance, and growth potential while maintaining a level of privacy and control. This article provides a comprehensive guide on the features, benefits, and other considerations associated with Private Limited Companies in India.

Key Features

- Restricted Transfer of Shares One of the defining features of a Private Limited Company is that its shareholders cannot freely transfer shares without the approval of other shareholders. This restriction helps maintain control within a select group, making the company a more secure and private business structure.

- Limited Number of Shareholders The maximum number of shareholders allowed in a Private Limited Company is 200. This feature ensures that the company remains closely held, making it easier for the founders to retain significant control while bringing in investors as needed.

- Minimum Number of Members At least two members are required to form a Private Limited Company. This structure ensures that the business is effectively managed while still allowing the founders to share responsibilities.

- Prohibition on Public Subscription Unlike public companies, a Private Limited Company is prohibited from inviting the public to subscribe to its shares or debentures. This characteristic is essential for maintaining the private nature of the company.

Advantages of a Private Limited

- Limited Liability Protection One of the most significant advantages of a Private Limited Company is that its shareholders enjoy limited liability. This means that their personal assets are protected against any business liabilities. The shareholders’ risk is limited to the amount unpaid on their shares, offering an added layer of financial security.

- Separate Legal Entity A Private Limited Company has its own separate legal identity, distinct from that of its owners. It can own property, incur debts, sue or be sued, and enter into contracts independently. This distinct legal entity status offers flexibility in conducting business and limits personal exposure for the shareholders.

- Perpetual Succession A Private Limited Company enjoys perpetual succession, which means that its existence is not dependent on the lives of its shareholders or directors. Even if shareholders leave the company, resign, or pass away, the company will continue to exist and operate without interruption.

- Ease of Fundraising Though Private Limited Companies cannot invite public investment, they can raise capital through private placements, venture capital, and angel investors. The limited liability aspect and structured nature of a PLC make it attractive to investors, allowing founders to bring in funding while maintaining control over the company.

- Tax Benefits Private Limited Companies often enjoy tax advantages compared to other business structures. The Indian government provides several incentives for companies to support economic growth. Additionally, being a recognized corporate entity, it may be easier to avail deductions, including expenses directly related to running the business.

Compliance Requirements for Private Limited Companies

- ROC Filings: A Private Limited Company must comply with annual ROC (Registrar of Companies) filing requirements, including financial statements and annual returns. This transparency ensures legal compliance and the continued functioning of the company.

- Auditing Requirements: Unlike some other business structures, such as Limited Liability Partnerships (LLPs), all Private Limited Companies are required to have their financial accounts audited annually, regardless of turnover.

Private Company vs. LLP Which is Better?

When deciding between a Private Limited Company and a Limited Liability Partnership (LLP), understanding the nature and goals of your business is essential. Here’s a quick comparison:

- Ownership and Liability: LLPs are more flexible when it comes to the number of partners, while Private Limited Companies have a limit of 200 shareholders.

- Compliance Requirements: LLPs have simpler compliance procedures compared to Private Limited Companies. For instance, the audit requirement in LLPs is applicable only when the turnover exceeds ₹40 lakh.

- Tax and Benefits: Private Limited Companies often have greater access to tax benefits and incentives compared to LLPs, making them preferable for businesses aiming for high growth and external investments.

Relevant Case Laws

- Madhya Pradesh High Court Ruling on Corporate ComplianceIn a recent ruling by the Madhya Pradesh High Court, the issue of compliance irregularities by private companies was brought to light. The court reiterated that private companies must maintain accurate books and file regular returns to avoid penalties, highlighting the importance of staying compliant with ROC requirements.

- Supreme Court on Perpetual SuccessionThe Supreme Court, in a landmark decision, reiterated that the death of shareholders or directors in a Private Limited Company does not affect its existence, showcasing the resilience and operational continuity of the PLC structure.

Private Limited Companies offer an ideal mix of growth potential, limited liability, and structured governance, making them a preferred choice for entrepreneurs and startups in India. Understanding the key features, advantages, and compliance requirements helps in making an informed decision when setting up your business.

If you’re looking to establish your own Private Limited Company or need assistance with ROC filings, Efiletax is here to provide professional support throughout the entire process. Feel free to reach out to us for expert guidance.

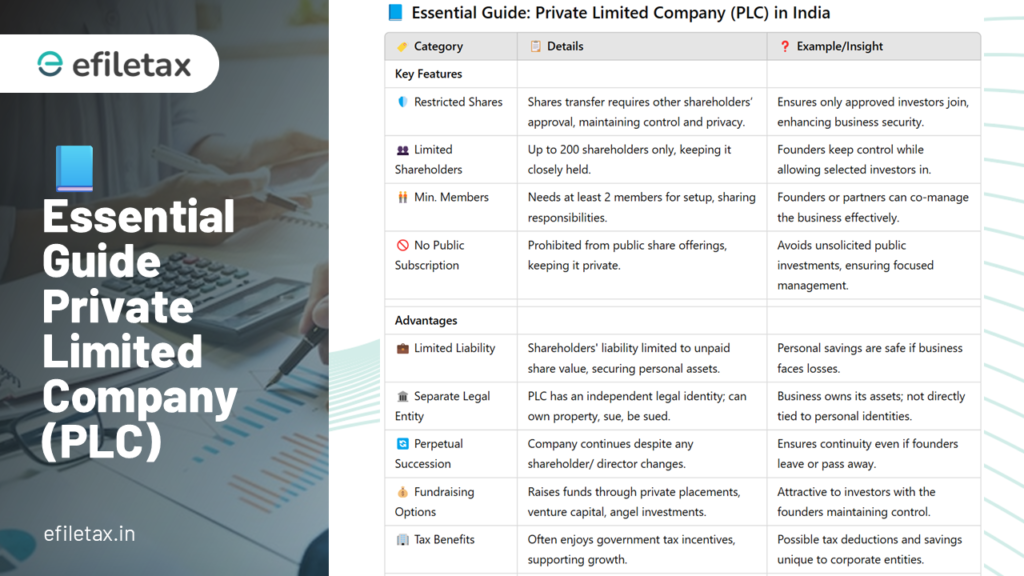

| 🏷️ Category | 📋 Details | ❓ Example/Insight |

|---|---|---|

| Key Features | ||

| 🛡️ Restricted Shares | Shares transfer requires other shareholders’ approval, maintaining control and privacy. | Ensures only approved investors join, enhancing business security. |

| 👥 Limited Shareholders | Up to 200 shareholders only, keeping it closely held. | Founders keep control while allowing selected investors in. |

| 🧑🤝🧑 Min. Members | Needs at least 2 members for setup, sharing responsibilities. | Founders or partners can co-manage the business effectively. |

| 🚫 No Public Subscription | Prohibited from public share offerings, keeping it private. | Avoids unsolicited public investments, ensuring focused management. |

| Advantages | ||

| 💼 Limited Liability | Shareholders’ liability limited to unpaid share value, securing personal assets. | Personal savings are safe if business faces losses. |

| 🏛️ Separate Legal Entity | PLC has an independent legal identity; can own property, sue, be sued. | Business owns its assets; not directly tied to personal identities. |

| 🔄 Perpetual Succession | Company continues despite any shareholder/ director changes. | Ensures continuity even if founders leave or pass away. |

| 💰 Fundraising Options | Raises funds through private placements, venture capital, angel investments. | Attractive to investors with the founders maintaining control. |

| 🏢 Tax Benefits | Often enjoys government tax incentives, supporting growth. | Possible tax deductions and savings unique to corporate entities. |

| Compliance Requirements | ||

| 📑 ROC Filings | Annual financial statements and returns with ROC. | Helps maintain transparency and legal compliance. |

| 📋 Auditing | Annual audits mandatory, regardless of turnover. | Ensures financial accuracy and integrity for stakeholders. |

| Comparison with LLP | ||

| 💼 Ownership & Liability | LLPs allow more flexibility with partners; PLC has a max of 200 shareholders. | LLPs better for flexible ownership; PLC suits controlled equity. |

| 📄 Compliance | LLPs have simpler compliance; PLCs require annual audits. | LLP audits only for turnover > ₹40 lakh. |

| 🏛️ Tax & Benefits | PLCs access more tax benefits, ideal for growth-focused businesses seeking external funds. | PLCs gain deductions, attractive for expanding ventures. |

| Relevant Case Laws | ||

| ⚖️ Madhya Pradesh High Court | Stressed PLCs’ compliance in maintaining accurate records, avoiding penalties. | Non-compliance can lead to legal penalties, critical for smooth ops. |

| 🏛️ Supreme Court on Succession | Ruled that PLCs endure beyond shareholders’ or directors’ lifespan. | Reinforces PLC’s stability for uninterrupted operation. |

🔍 Q&A

Q: Is a Private Limited Company the best choice for small businesses?

A: It depends on your needs. If you seek external funding and structured governance with limited liability, it’s a great option.

📢 Thinking about starting a Private Limited Company? Reach out to efiletax for guidance on ROC filings and compliance!