What is a One Person Company (OPC)?

A One Person Company (OPC) is a unique business structure introduced in India under the Companies Act, 2013, aimed at providing entrepreneurs with the advantages of a private limited company while allowing them to retain sole ownership. This hybrid model blends the simplicity of sole proprietorship with the corporate advantages of limited liability. OPC offers a legal entity separate from the individual owner, thereby protecting personal assets from business liabilities.

Features of One Person Company (OPC):

- Owned by a Single Individual: OPC is owned and managed by a single individual, who acts as both the director and shareholder. This provides full control over business decisions while enjoying the benefits of limited liability.

- Separate Legal Entity: OPC has a distinct legal identity, allowing the owner to keep personal assets separate from business liabilities. This reduces risk for the individual, as business debts cannot be claimed against personal property.

- Nominee Requirement: During registration, an OPC must appoint a nominee, who will assume control in the event of the owner’s death or incapacity. This ensures business continuity and protects the interests of stakeholders.

- Limited Liability: One of the most significant advantages of OPC is the limited liability protection it offers. The owner’s financial exposure is restricted to their capital contribution in the business.

- Annual Compliance: OPCs must comply with certain annual requirements, including the filing of financial statements and annual returns with the Registrar of Companies (RoC). However, compliance is generally simpler compared to other corporate structures.

- Taxation: OPCs are taxed as private limited companies, with corporate tax rates applicable. There are minimal tax advantages for OPCs compared to sole proprietorships.

- Conversion Requirement: An OPC must convert into a private limited company if its turnover exceeds ₹2 crores or its paid-up capital crosses ₹50 lakhs in any financial year.

- No Foreign Direct Investment (FDI): OPCs are not eligible for FDI, which limits foreign investment potential.

Advantages of One Person Company (OPC):

- Sole Ownership with Control: OPC allows a single individual to manage the business entirely, providing freedom in decision-making.

- Limited Liability Protection: Unlike sole proprietorships, the owner’s liability is limited, providing personal asset protection.

- Ease of Compliance: OPC enjoys several compliance relaxations, such as exemptions from holding Annual General Meetings and simplified financial reporting requirements.

- Perpetual Succession: With the requirement of a nominee, OPCs offer continuity even if the sole owner becomes incapable of managing the business.

Disadvantages of One Person Company (OPC):

- Limited Growth Potential: Since OPC cannot have more than one shareholder, it limits the ability to bring in additional capital or investors. This affects scalability compared to private limited companies.

- High Taxation Rates: OPCs are subject to corporate tax rates, which can be higher compared to individual income tax rates for sole proprietors.

- No Equity Funding: The inability to raise equity funds or offer employee stock options restricts growth opportunities.

Why Prefer OPC Over Sole Proprietorship?

When comparing OPC to sole proprietorship, the primary factor to consider is limited liability. In a sole proprietorship, the owner bears unlimited liability, meaning their personal assets are at risk if the business incurs debts. In contrast, OPC limits the owner’s liability, protecting personal wealth.

Another important aspect is the separate legal entity status of an OPC. This distinction enables entrepreneurs to build business credit, secure loans, and establish a professional identity. Moreover, the requirement of a nominee provides perpetual existence for the business, which means it can continue to operate seamlessly even if the original owner passes away or becomes incapacitated.

However, OPC has higher compliance costs and taxation compared to sole proprietorships. Entrepreneurs must weigh these factors against the benefits of asset protection, continuity, and formal corporate structure.

One Person Company (OPC) offers a beneficial structure for solo entrepreneurs who wish to maintain full control over their business while enjoying the perks of limited liability and corporate structure. Though it has certain limitations, such as restricted scalability and high tax rates, it is an excellent choice for those looking to establish a formal business structure with a single owner. Sole proprietors considering legal liability protection and business continuity might find OPC the perfect fit for their aspirations.

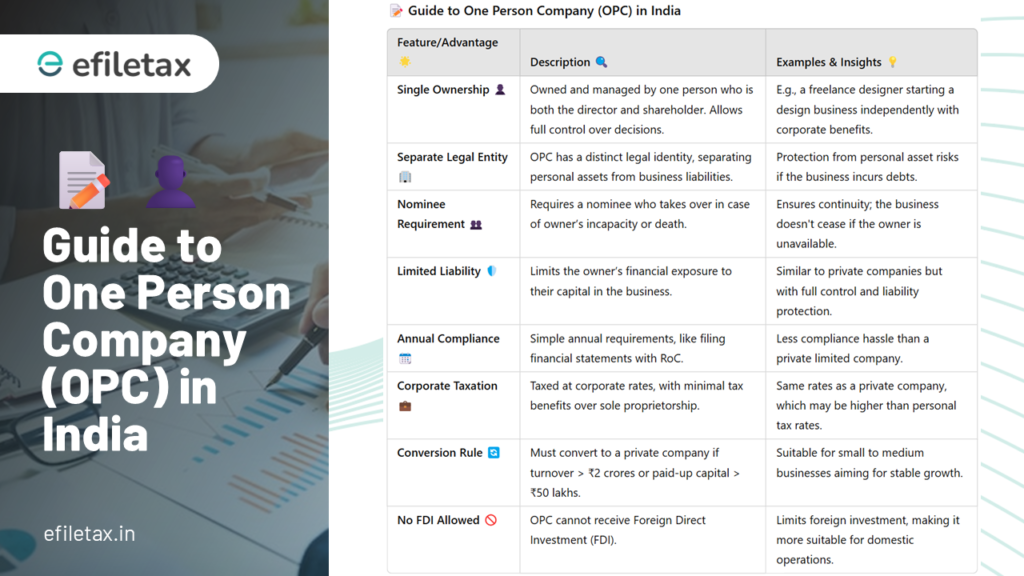

📝 Guide to One Person Company (OPC) in India

| Feature/Advantage 🌟 | Description 🔍 | Examples & Insights 💡 |

|---|---|---|

| Single Ownership 👤 | Owned and managed by one person who is both the director and shareholder. Allows full control over decisions. | E.g., a freelance designer starting a design business independently with corporate benefits. |

| Separate Legal Entity 🏢 | OPC has a distinct legal identity, separating personal assets from business liabilities. | Protection from personal asset risks if the business incurs debts. |

| Nominee Requirement 👥 | Requires a nominee who takes over in case of owner’s incapacity or death. | Ensures continuity; the business doesn’t cease if the owner is unavailable. |

| Limited Liability 🛡️ | Limits the owner’s financial exposure to their capital in the business. | Similar to private companies but with full control and liability protection. |

| Annual Compliance 📆 | Simple annual requirements, like filing financial statements with RoC. | Less compliance hassle than a private limited company. |

| Corporate Taxation 💼 | Taxed at corporate rates, with minimal tax benefits over sole proprietorship. | Same rates as a private company, which may be higher than personal tax rates. |

| Conversion Rule 🔄 | Must convert to a private company if turnover > ₹2 crores or paid-up capital > ₹50 lakhs. | Suitable for small to medium businesses aiming for stable growth. |

| No FDI Allowed 🚫 | OPC cannot receive Foreign Direct Investment (FDI). | Limits foreign investment, making it more suitable for domestic operations. |

Advantages of Choosing OPC Over Sole Proprietorship

| Advantage 🟢 | Explanation 📋 |

|---|---|

| Sole Control with Limited Liability 🛡️ | Freedom to manage the business fully while enjoying personal asset protection. |

| Perpetual Succession 🔄 | Business continuity with the nominee arrangement, unlike sole proprietorship. |

| Professional Identity 💼 | Recognized as a corporate entity, helps in establishing business credit and securing loans. |

Disadvantages of OPC

| Disadvantage 🔴 | Explanation 📋 |

|---|---|

| Limited Growth Potential 📉 | Cannot have additional shareholders, affecting scalability and growth. |

| Higher Tax Rates 💸 | Corporate tax rates are higher than individual income tax for sole proprietors. |

| No Equity Funding 🚫 | Unable to raise equity funds or offer employee stock options. |

FAQs: Common Questions on OPC ❓

| Question | Answer |

|---|---|

| Why should I choose OPC over a sole proprietorship? | OPC offers liability protection, separates personal assets from business liabilities, and provides continuity. Ideal if you need asset protection and a formal corporate structure. |

| What are the annual compliance requirements? | OPCs need to file financial statements and annual returns with RoC, simpler than a private limited company. |

| Can an OPC receive foreign investment? | No, OPCs cannot accept FDI. They are more suitable for businesses focused on the domestic market. |

Thinking about forming your own OPC? efiletax can guide you through the registration process and ensure smooth compliance. Contact us to get started on securing your business future!