No GST on UPI transactions above ₹2000 — this official clarification from the Ministry of Finance busts the viral misinformation circulating on social media. Here’s what Indian taxpayers and digital merchants need to know.

🔎 What Was the Viral Claim?

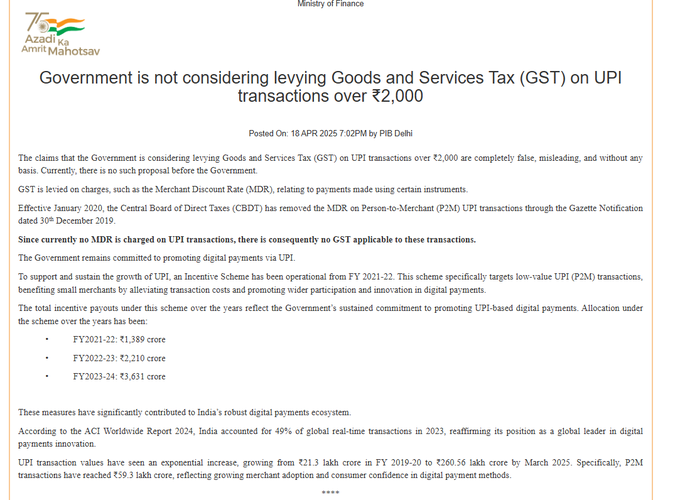

A rumour suggested that GST would be imposed on UPI payments exceeding ₹2,000, sparking widespread concern among small businesses, digital users, and fintech communities.

✅ Government’s Official Clarification

According to the PIB Press Release (18 April 2025):

- No such GST proposal exists with the government.

- GST is only levied on service charges, such as the Merchant Discount Rate (MDR) — not on the transaction value itself.

- There is no MDR on Person-to-Merchant (P2M) UPI transactions.

- Hence, no GST is applicable to such UPI transactions.

📜 Legal Reference:

The waiver of MDR was notified via Gazette Notification dated 30 December 2019, by the Central Board of Direct Taxes (CBDT).

🧾 When Does GST Apply to Digital Payments?

| Payment Type | MDR Charged? | GST on Transaction? |

|---|---|---|

| UPI (Person to Merchant) | ❌ No | ❌ No |

| Debit/Credit Cards | ✅ Yes | ✅ Yes (on MDR) |

| Wallet or Payment Gateway | ✅ Yes (some) | ✅ Yes (on MDR) |

📌 Key Point: GST is only applied on fees, not the transaction value.

💡 UPI Incentive Scheme: Driving Cost-Free Digital Payments

To promote UPI, especially low-value P2M transactions, the government launched an Incentive Scheme from FY 2021–22, providing financial support to banks and system providers.

📊 Year-wise Incentive Allocation:

| Financial Year | Incentive Payout |

|---|---|

| FY 2021–22 | ₹1,389 crore |

| FY 2022–23 | ₹2,210 crore |

| FY 2023–24 | ₹3,631 crore |

This support helps small merchants accept UPI at zero cost, increasing adoption.

🌍 India’s Global UPI Leadership: 2023–2025 Snapshot

As per the ACI Worldwide Report (2024):

- 🇮🇳 India accounted for 49% of all global real-time transactions in 2023.

- UPI’s total transaction value jumped from ₹21.3 lakh crore in FY 2019–20 to ₹260.56 lakh crore by March 2025.

- P2M transactions alone crossed ₹59.3 lakh crore, reflecting the booming adoption by merchants.

💬 Expert View: Why This Matters for Small Businesses

“Removing MDR and keeping GST away from UPI ensures cost-free digital payments for shops and vendors. India’s fintech growth depends on policy stability like this.”

— Tax Advisor, Efiletax

✅ Summary Snippet (For Google Rich Results)

No GST on UPI transactions above ₹2000, confirms PIB. GST applies only to service charges like MDR — which is waived for UPI (P2M). India remains committed to cost-free digital payments.

🧠 FAQs

Q1. Is GST applied on UPI if I send over ₹2000?

No. GST doesn’t apply to the transaction value. Only service fees (if any) attract GST — and UPI has none for P2M.

Q2. What is MDR and why is it important here?

MDR is a charge by banks/payment gateways. Since MDR is waived for UPI P2M, no GST applies.

Q3. Could this change in the future?

As of now, the government has no proposal to levy GST on UPI transactions.

Still unsure about how GST affects your digital transactions?

Talk to efiletax experts — your trusted guide for GST, UPI, and digital tax compliance.