Introduction

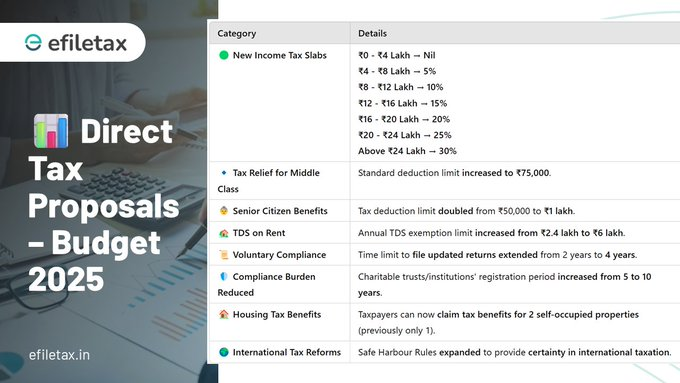

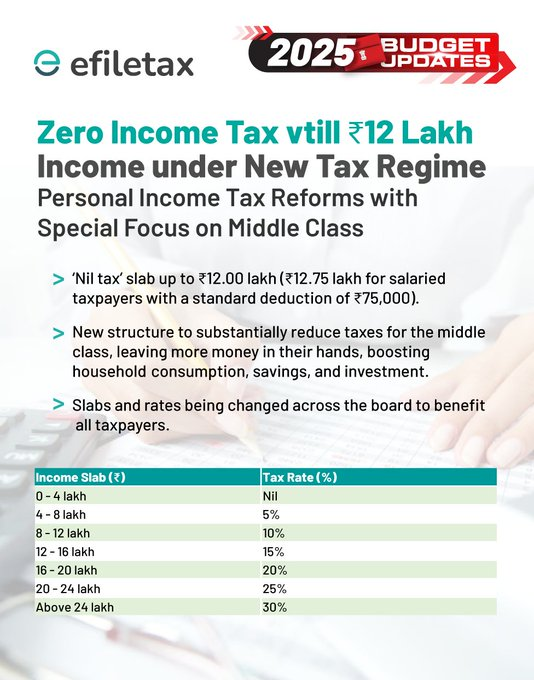

The Indian government has introduced significant personal income tax reforms, focusing on middle-class taxpayers. With the Budget 2025, the new tax regime brings revised slabs, increased tax-free income limits, and enhanced benefits. Let’s explore these key changes and how they impact different income groups.

Key Features of the New Tax Regime

| Total Income (Rs.) | Tax Rate (Section 115BAC(1A)) |

|---|---|

| 0 – 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

1. Increased Tax-Free Income Limit

Under the proposed tax slabs, individuals earning up to ₹12 lakh can now enjoy a zero tax liability, subject to the rebate available in the new regime. This is a substantial increase from the previous limit of ₹7 lakh, benefiting approximately one crore taxpayers.

2. Standard Deduction and Taxpayer Benefits

- The standard deduction has been increased to ₹75,000, reducing taxable income for salaried individuals.

- This ensures that a salaried taxpayer with income up to ₹12,75,000 will not be required to pay tax after considering the deduction.

3. Marginal Relief for Taxpayers Above ₹12 Lakh

- To prevent tax burdens from rising steeply, a marginal relief mechanism has been introduced.

- For instance, an individual earning ₹12,10,000 would have a tax liability of ₹61,500 as per the slabs, but due to marginal relief, the actual tax payable is only ₹10,000.

4. Overall Tax Savings Across Different Income Levels

| Total Income (Rs.) | Tax as per Existing Rates (2024) | Tax as per Proposed Rates (2025) | Total Benefit (₹) |

| 8,00,000 | 30,000 | 20,000 | 10,000 |

| 10,00,000 | 50,000 | 40,000 | 10,000 |

| 12,00,000 | 80,000 | 60,000 | 20,000 |

| 15,00,000 | 1,40,000 | 1,05,000 | 35,000 |

| 20,00,000 | 2,90,000 | 2,00,000 | 90,000 |

5. How to Avail Benefits of NIL Tax Liability?

- The new tax regime is now the default option.

- Taxpayers only need to file their income tax return (ITR) to claim the benefits. No additional steps are required.

Who Benefits the Most?

- Middle-Class Earners: Individuals with an annual income of up to ₹24 lakh will see reduced tax burdens.

- Salaried Employees: With the higher standard deduction, net taxable income decreases, leading to additional savings.

- First-Time Taxpayers: Those entering the workforce benefit from a simple and lower tax structure.

Impact on the Economy

With these reforms, the government aims to:

- Boost disposable income, increasing consumer spending.

- Encourage tax compliance, making filing easier and more beneficial.

- Support economic growth, by leaving more money in the hands of the taxpayers.

Conclusion

The new tax regime under Budget 2025 marks a progressive step towards tax simplification and relief for middle-class taxpayers. By raising the zero-tax limit to ₹12 lakh, increasing standard deductions, and offering marginal relief, this structure makes taxation more efficient and beneficial for millions of Indians.

Have questions about the new tax regime? Get expert tax filing assistance on Efiletax.in today!