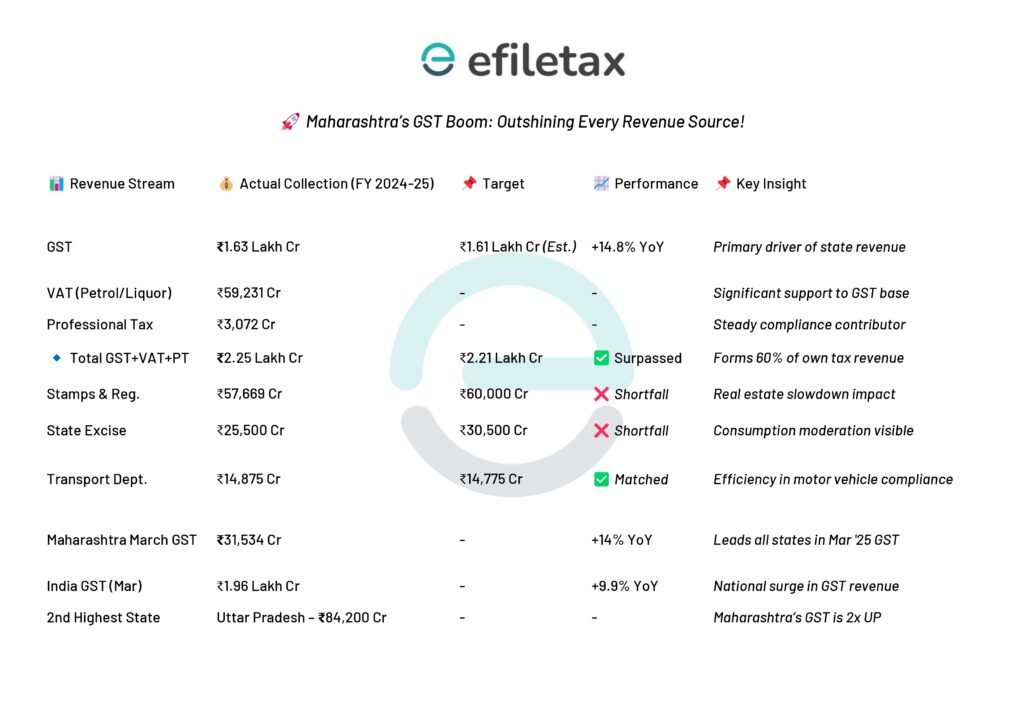

Maharashtra GST collection has set a new benchmark in FY 2024-25, outperforming other revenue departments and emerging as the state’s primary tax contributor. Against the estimated target of Rs 2.21 lakh crore, the state clocked in Rs 2.25 lakh crore, marking a 13.6% year-on-year growth.

GST: Maharashtra’s Fiscal Backbone

Maharashtra’s tax revenue sources include:

- State GST: Rs 1.63 lakh crore

- VAT (on liquor and petroleum): Rs 59,231 crore

- Professional Tax: Rs 3,072 crore

This combined to Rs 2.25 lakh crore, making GST and associated taxes contribute 60% of the state’s own tax revenue.

Comparative Performance of Departments

| Department | Actual Collection (Rs Cr) | Budget Estimate (Rs Cr) | % Achievement |

|---|---|---|---|

| GST + VAT + PT | 2,25,303 | 2,21,000 | 102% |

| Stamps & Registration | 57,669 | 60,000 | 96% |

| State Excise | 25,500 | 30,500 | 84% |

| Transport | 14,875 | 14,775 | 101% |

National Context: Maharashtra Leads the Pack

In March 2025 alone:

- India’s GST collection rose 9.9% YoY to Rs 1.96 lakh crore.

- Maharashtra contributed Rs 31,534 crore, up 14% from March 2024.

- Other top contributors: Karnataka, Gujarat, Tamil Nadu, Uttar Pradesh.

Expert Insight: What This Signals

According to GST practitioners, Maharashtra’s success reflects:

- Better compliance enforcement post-e-invoicing and AI-led analytics.

- Resilient business activity despite economic headwinds.

- Failure of other departments to meet projections highlights the GST regime’s maturity.

Legal Basis & Sources

- GST Revenue Data: Maharashtra State GST Department

- Budget Estimates: Maharashtra Finance Department

- National GST Figures: Ministry of Finance, GoI https://www.pib.gov.in

Why It Matters for Taxpayers

- The state may avoid introducing new levies or hikes due to surplus GST.

- Businesses must stay vigilant on compliance as stricter enforcement continues.

- Strong revenue gives room for state-led subsidies and development spending.

Final Takeaway

Maharashtra’s robust GST collection isn’t just a number – it’s a signal of economic resilience, policy efficiency, and the growing role of indirect taxes in India’s federal fiscal structure.

Need help with GST registration, filing or audits?

Talk to our experts at Efiletax.in for a free consultation.

FAQ (Optional for SEO)

Q1. What is Maharashtra’s GST collection for FY 2024-25?

A1. Rs 2.25 lakh crore, surpassing the estimate of Rs 2.21 lakh crore.

Q2. Which department underperformed?

A2. State Excise missed its target by over Rs 5,000 crore.

Q3. Why did Maharashtra outperform other states?

A3. Better compliance, strong commercial activity, and tech-driven monitoring.