What is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership (LLP) is an innovative business entity that merges the benefits of limited liability, typical of a company, with the operational flexibility of a partnership. LLPs were introduced in India by the Limited Liability Partnership Act, 2008, and have since become popular for businesses seeking a simpler management structure combined with liability protection.

Unlike traditional partnerships, LLPs limit the liabilities of their partners to the contributions they make to the business. This means that each partner is shielded from any debts or malpractice caused by other partners. This feature makes LLPs an attractive option for entrepreneurs who want to minimize risk while maintaining management freedom.

Key Features of LLPs

1. Limited Liability with Partnership Flexibility

An LLP provides its partners with limited liability, ensuring their personal assets are safeguarded in case of business losses or debts, unless the loss is due to fraud or misconduct by an individual partner. This creates a barrier between personal and business finances, similar to a private limited company.

2. Suitable for Small to Medium Businesses

An LLP is ideal for businesses that do not plan on raising equity funding. It is commonly used in service industries, professional practices, and small to medium enterprises where external financing needs are limited.

3. Reduced Compliance Requirements

Compared to private limited companies, LLPs benefit from reduced compliance obligations. For instance, statutory audits are only required for LLPs with a turnover exceeding ₹40 lakhs or a capital contribution of more than ₹25 lakhs. This makes LLPs a cost-effective option for many small business owners.

4. No Limit on Partners

Unlike traditional partnerships that limit the number of partners, LLPs can have an unlimited number of partners, making them ideal for professional service firms or larger entities that need more hands on deck without concerns over management caps.

5. Perpetual Succession

The LLP continues to exist irrespective of changes in partner composition. This means that the exit, death, or retirement of a partner does not dissolve the LLP, providing greater stability to the business.

Tax Implications of LLPs

Tax considerations often play a critical role in deciding the right business structure. LLPs are taxed at a flat rate, similar to companies, but unlike traditional partnerships or sole proprietorships, partners’ liabilities are limited to the amount they have invested. While this means higher compliance costs compared to unregistered partnerships, LLPs still enjoy a favorable tax structure, without the double taxation typically faced by corporate entities.

LLP vs Private Limited Company: Which One is Right for You?

The choice between an LLP and a private limited company comes down to the nature of your business and long-term goals.

- LLPs are well-suited for businesses with modest operational scales, minimal equity funding requirements, and simpler compliance needs. They are also an excellent choice for service industries where management responsibilities are shared among partners.

- Private Limited Companies, on the other hand, are better for larger-scale operations needing equity funding, raising outside investments, or offering employee stock options (ESOPs).

LLPs, like private limited companies, provide limited liability, but the LLP structure avoids the need for frequent board meetings and annual returns required by companies, making it more efficient for those looking to operate at a smaller scale.

Case Study: Limited Liability in Action

Consider a scenario where an LLP partner commits a financial misstep due to negligence. In a General Partnership, this could mean that all partners face legal action or financial burdens. However, under the LLP framework, liability for such actions remains restricted to the responsible partner, providing better protection for others involved. This was upheld by the Madhya Pradesh High Court, which ruled in favor of limited liability protections under the LLP Act, emphasizing the safety it provides to non-culpable partners.

Advantages and Disadvantages of LLP

Advantages:

- Limited liability protects personal assets.

- Simplified management through a mutually agreed internal framework.

- Reduced compliance costs compared to private limited companies.

Disadvantages:

- Not suitable for raising equity from public investors.

- Higher compliance compared to traditional partnerships.

Conclusion

A Limited Liability Partnership (LLP) is a flexible, low-compliance, and cost-effective solution for businesses seeking a modern structure that still offers the traditional ease of partnership. It is a great choice for professional service providers, consultants, and SMEs where management participation and liability protection are crucial.

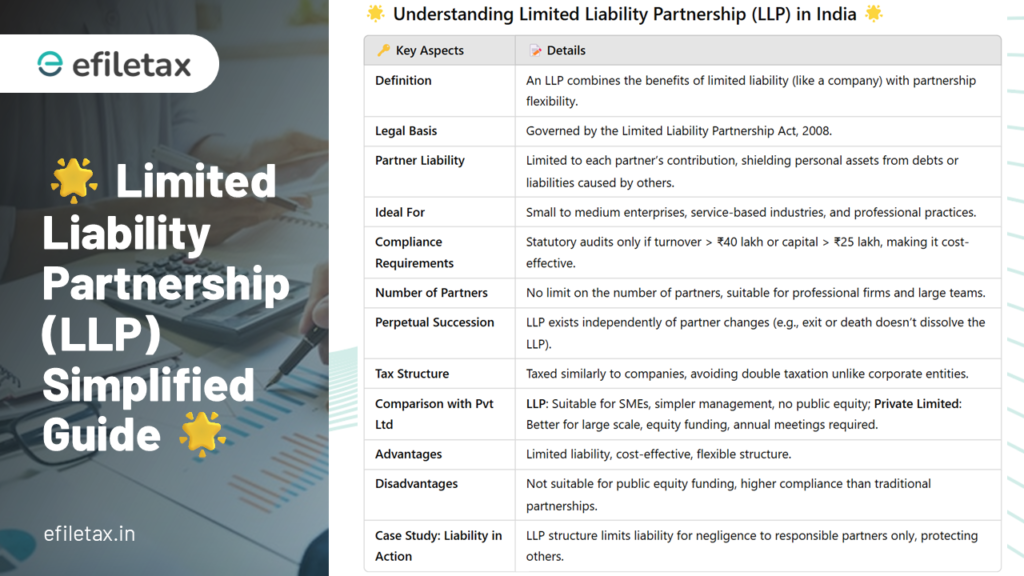

🌟 Understanding Limited Liability Partnership (LLP) in India 🌟

| 🔑 Key Aspects | 📝 Details |

|---|---|

| Definition | An LLP combines the benefits of limited liability (like a company) with partnership flexibility. |

| Legal Basis | Governed by the Limited Liability Partnership Act, 2008. |

| Partner Liability | Limited to each partner’s contribution, shielding personal assets from debts or liabilities caused by others. |

| Ideal For | Small to medium enterprises, service-based industries, and professional practices. |

| Compliance Requirements | Statutory audits only if turnover > ₹40 lakh or capital > ₹25 lakh, making it cost-effective. |

| Number of Partners | No limit on the number of partners, suitable for professional firms and large teams. |

| Perpetual Succession | LLP exists independently of partner changes (e.g., exit or death doesn’t dissolve the LLP). |

| Tax Structure | Taxed similarly to companies, avoiding double taxation unlike corporate entities. |

💼 LLP vs Private Limited Company

| Criteria | LLP | Private Limited Company |

|---|---|---|

| Equity Funding | Not ideal for equity funding | Ideal for equity funding, external investments, ESOPs |

| Compliance Level | Reduced; simpler management | Higher compliance; annual returns, board meetings |

| Suitability | SMEs, service industries, professional firms | Larger-scale businesses with growth/funding needs |

⚖️ Case Study: Limited Liability in Action

Imagine a scenario where one partner in an LLP incurs a financial liability due to negligence. Unlike a general partnership, where all partners may be liable, in an LLP, liability is limited to the responsible partner, safeguarding others. A Madhya Pradesh High Court ruling upheld this protection, showcasing the LLP’s strength in risk mitigation.

🟢 Advantages vs 🔴 Disadvantages of LLP

| 🟢 Advantages | 🔴 Disadvantages |

|---|---|

| Limited liability safeguards personal assets. | Not suitable for public equity funding. |

| Flexible, lower compliance than private firms. | Higher compliance than traditional partnerships. |

| Cost-effective and stable management structure. |

👥 Q&A: Common Questions

Q: Can LLPs raise public equity?

A: No, LLPs are typically not suitable for public equity funding.

Q: How many partners can an LLP have?

A: There’s no limit, allowing flexibility for large teams.

Q: Is an LLP taxed differently from a partnership?

A: Yes, LLPs have a favorable tax structure similar to companies, avoiding double taxation.