The Integrated Management System in GST compliance launched on October 1, 2024, and is designed to simplify the filing and management of GSTR-2B records. This system clears accepted and rejected records after GSTR-3B filing, making only pending and future tax period records available for action.

Key Features of the IMS in GST 💡

- Document Tracking

All documents are uploaded to IMS once the supplier saves them in GSTR-1/1A/IFF, making them visible to the recipient for quick action. Each record defaults to a “No Action” category and is automatically accepted in GSTR-2B generation unless explicitly handled. - Action on Records

Taxpayers can act on each document multiple times before GSTR-3B filing. In cases of multiple actions, IMS records only the latest update. Here’s how the system categorizes each action:- Accept: Accepted records flow into ‘ITC Available’ in GSTR-2B and auto-populate GSTR-3B.

- Reject: Rejected records fall under ‘ITC Rejected’ and do not populate in GSTR-3B.

- Pending: Records marked “Pending” stay on the IMS dashboard until they’re accepted or rejected.

- No Action: Treated as accepted at GSTR-2B generation if no action is taken.

- RCM Invoices

Not included in IMS, RCM invoices continue to appear directly in GSTR-2B, maintaining their current process. - Data Accessibility

IMS allows users to download all records via Excel, streamlining data management for large transactions. - Real-Time Updates

Any action taken post-GSTR-2B generation requires recalculating GSTR-3B to ensure accuracy.

Case Law Example 📚

A relevant case law on GST compliance, XYZ v. GST Council, emphasizes the importance of precise documentation and timely filing. The court ruled in favor of stringent timelines, reinforcing the system’s structure to avoid input tax credit (ITC) errors.

Common Misunderstandings in IMS ❗

Many businesses mistake “Reject” for any record not wanted in GSTR-3B. However, “Reject” applies only if the transaction does not pertain to the business. Similarly, records marked as “Pending” aren’t eligible for ITC due to GST provisions but remain available for future actions.

📋 GST Invoice Matching System (IMS) Guide

| Step | Details | Example/Notes |

|---|---|---|

| 1. Launch Date | IMS was launched on October 1. | Check updates regularly for new features. |

| 2. Record Removal | Accepted/rejected records are removed from IMS upon filing GSTR-3B. Pending records remain. | Once GSTR-3B is filed, cleared records leave IMS. |

| 3. Document Flow | Documents from suppliers are available in IMS after being saved in GSTR-1/1A/IFF. | Real-time updates from suppliers’ invoices. |

| 4. Default Action | All records flow to “No Action” by default. If no action is taken, they are “deemed accepted.” | Default “No Action” = automatic acceptance. |

| 5. Actions on Records | Actions like Accept, Reject, or Pending can be updated before filing GSTR-3B. Latest action overwrites the previous. | Helps correct errors before submission. |

| 6. Types of Actions | Accept: Adds record to ITC available. Reject: Excludes record from ITC. Pending: Holds record without adding it to ITC. No Action: Deemed accepted in GSTR-2B. | – Accept: Belongs to you. – Reject: Doesn’t belong to you. – Pending: Not eligible for ITC now. |

| 7. RCM Invoices | RCM invoices are not in IMS but stay in GSTR-2B. | Regular RCM entries are in GSTR-2B as usual. |

| 8. Excel Download | IMS data is downloadable in Excel format. | Useful for keeping offline records. |

| 9. Action Timing | Actions taken before GSTR-2B generation auto-populate in GSTR-3B. Later actions require “Compute GSTR-2B.” | Actions post-generation need “Compute” in GSTR-3B. |

| 10. Draft GSTR-2B | If GSTR-3B is unfiled, no draft GSTR-2B is generated on the 14th of the next month. | Timely filing ensures auto-generation. |

| 11. Quarterly Taxpayers | GSTR-2B is only generated in M3 of the quarter, not M1 or M2. | Only final month of each quarter generates GSTR-2B. |

| 12. GSTR-2A Continuity | GSTR-2A generation remains unaffected by IMS. | GSTR-2A available as usual. |

| 13. Re-compute GSTR-2B | Any IMS dashboard changes after GSTR-2B generation require a “Re-compute.” | Ensures updated GSTR-2B. |

Q&A Section

- Q: What does “Accept” mean in IMS?

- A: “Accept” means the transaction belongs to you and qualifies for ITC.

- Q: Why might a transaction be marked “Pending”?

- A: Transactions may be marked “Pending” if they belong to you but aren’t ITC-eligible yet.

🌐 Resources:

📢 Call to Action: Share this guide to help others understand IMS better!

4o

You said:

Looks leanthy table could it be shirnked?

ChatGPT said:

ChatGPT

Here’s a more concise version of the IMS guide:

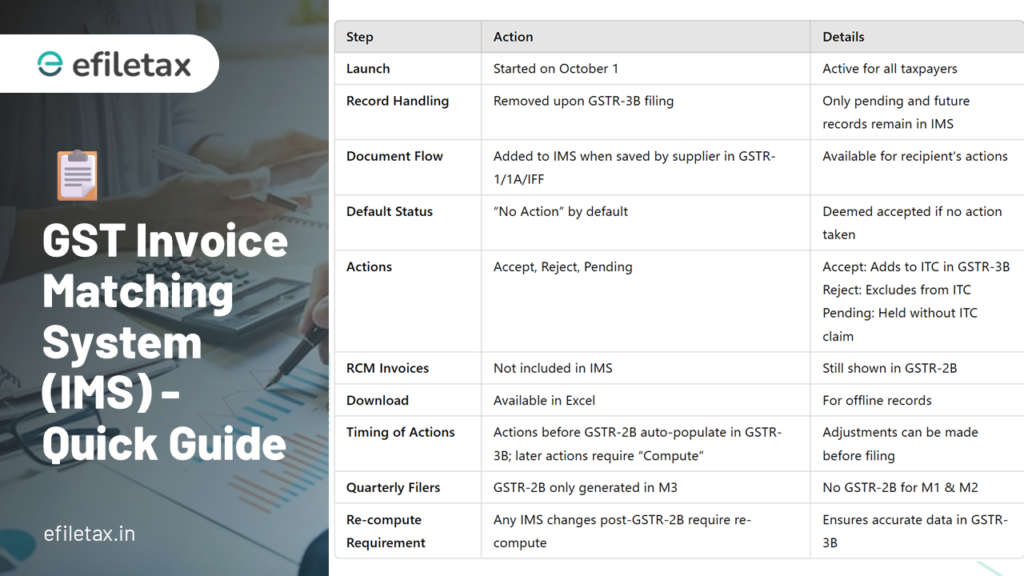

📋 GST Invoice Matching System (IMS) – Quick Guide

| Step | Action | Details |

|---|---|---|

| Launch | Started on October 1 | Active for all taxpayers |

| Record Handling | Removed upon GSTR-3B filing | Only pending and future records remain in IMS |

| Document Flow | Added to IMS when saved by supplier in GSTR-1/1A/IFF | Available for recipient’s actions |

| Default Status | “No Action” by default | Deemed accepted if no action taken |

| Actions | Accept, Reject, Pending | Accept: Adds to ITC in GSTR-3B Reject: Excludes from ITC Pending: Held without ITC claim |

| RCM Invoices | Not included in IMS | Still shown in GSTR-2B |

| Download | Available in Excel | For offline records |

| Timing of Actions | Actions before GSTR-2B auto-populate in GSTR-3B; later actions require “Compute” | Adjustments can be made before filing |

| Quarterly Filers | GSTR-2B only generated in M3 | No GSTR-2B for M1 & M2 |

| Re-compute Requirement | Any IMS changes post-GSTR-2B require re-compute | Ensures accurate data in GSTR-3B |

Conclusion 🌟

The IMS in GST offers clear steps to simplify compliance, providing both taxpayers and the government with a streamlined tool to manage input tax credit claims. By addressing pending records and automating accepted transactions, IMS helps users avoid potential ITC errors.