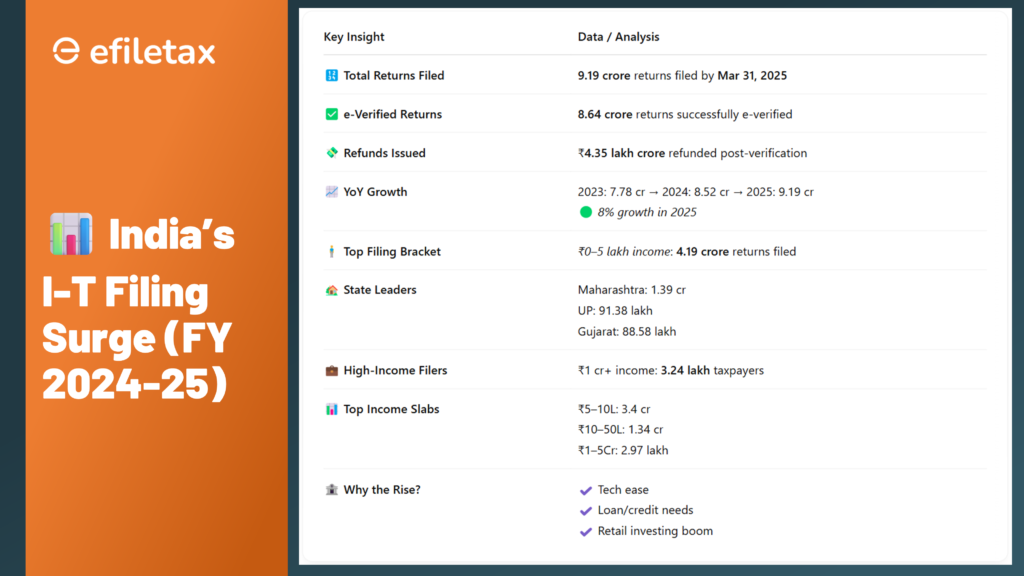

By March 31, 2025, India recorded 9.19 crore income tax return filings for FY 2024-25 — a consistent rise from previous years. Of these, 8.64 crore returns were successfully e-verified, and refunds of over ₹4.35 lakh crore have already been issued, as per the Income Tax Department portal.

This reflects a broader shift in taxpayer behavior, driven by rising incomes, easier digital filing, and compliance-linked financial access.

📈 Year-on-Year ITR Growth

| Financial Year | ITRs Filed | Growth (%) |

|---|---|---|

| FY 2022-23 | 7.78 crore | — |

| FY 2023-24 | 8.52 crore | +7% |

| FY 2024-25 | 9.19 crore | +8% |

Key takeaway: Consistent yearly growth points to expanding tax net and stronger digital adoption.

🧾 State-Wise Income Tax Filing Snapshot

| State | Returns Filed (in lakh) |

|---|---|

| Maharashtra | 139.00 |

| Uttar Pradesh | 91.38 |

| Gujarat | 88.58 |

| Rajasthan | 59.77 |

| Tamil Nadu | 57.27 |

| Karnataka | 53.62 |

| Delhi | 44.66 |

| Punjab | 44.26 |

Maharashtra leads, but Gujarat’s numbers show strong compliance relative to population.

💼 Income-Wise Breakdown of ITRs Filed

| Annual Income Range | Returns Filed |

|---|---|

| Below ₹5 lakh | 4.19 crore |

| ₹5–10 lakh | 3.4 crore |

| ₹10–50 lakh | 1.34 crore |

| ₹1–5 crore | 2.97 lakh |

| ₹5–10 crore | 16,797 |

| Above ₹10 crore | 10,184 |

Majority of India’s tax base still earns below ₹10 lakh annually, though HNI disclosures are rising.

🔍 Why Are ITR Filings Increasing?

According to tax professionals, several factors are driving this uptrend:

- Income growth across sectors, especially urban and service economies

- Digital filing simplification via Income Tax Portal and Aadhaar-PAN linkage

- Loan processing norms requiring ITRs for 3 years

- Rising retail investor base in mutual funds and stock markets

- Data integration with banks, TDS portals, and GSTN forcing formalisation

Income tax filing in India hit 9.19 crore in FY 2024-25, up 8% from last year. Maharashtra, Gujarat, and UP lead in return filings.

❓FAQs

Q1. What’s the deadline for ITR filing for FY 2024-25?

👉 July 31, 2025 (unless extended by CBDT)

Q2. Can I still claim refund after deadline?

👉 Yes, but only if you file a belated return by December 31, 2025 (with late fees).

Q3. Who should file ITR even if not taxable?

👉 Those applying for loans, visas, or tenders should file voluntarily for income proof.

📝 Final Note from Efiletax

India’s tax base is expanding — and staying compliant gives you more than refunds. It gives you access.

If you need help filing, e-verifying, or tracking your refund status — Efiletax is here to simplify it all