Income Tax Slabs FY 2024-25: New & Old Regime Compared

The Indian income tax system offers two regimes: the new regime with simplified rates and the old regime with deductions. Choosing the right one can maximise your savings. Let’s explore the income tax slabs for FY 2024-25 under both regimes, the key changes, and their impacts.

Income Tax Slabs Under the Old Regime

The old tax regime provides multiple deductions but has higher tax rates. Here are the slabs:

| Income Slabs | Tax Rate |

|---|---|

| Up to ₹2,50,000 | NIL |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Note:

- For senior citizens (60-80 years), the exemption limit is ₹3 lakh.

- For super senior citizens (80+ years), the limit is ₹5 lakh.

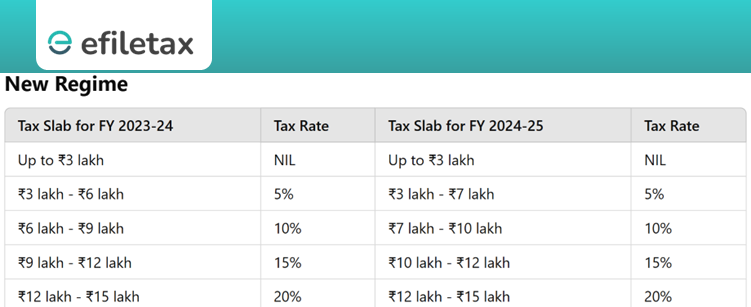

Income Tax Slabs Under the New Regime (FY 2024-25)

The new regime simplifies taxes with fewer deductions but lower rates. Here are the revised slabs:

| Income Slabs | Tax Rate |

|---|---|

| Up to ₹3,00,000 | NIL |

| ₹3,00,001 – ₹7,00,000 | 5% |

| ₹7,00,001 – ₹10,00,000 | 10% |

| ₹10,00,001 – ₹12,00,000 | 15% |

| ₹12,00,001 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

Key Changes in the New Tax Regime for FY 2024-25

- Higher Basic Exemption:

- The exemption limit is now ₹3 lakh for all taxpayers.

- Rebate u/s 87A:

- No tax if income is up to ₹7 lakh.

- Enhanced Standard Deduction:

- Increased to ₹75,000 for salaried taxpayers.

- Family Pension Deduction:

- Raised from ₹15,000 to ₹25,000.

- Reduced Surcharge:

- Highest surcharge rate reduced to 25% (from 37%).

Comparison of New vs Old Regime

| Income Slabs | Old Regime Rate | New Regime Rate |

|---|---|---|

| Up to ₹2,50,000 | NIL | NIL |

| ₹2,50,001 – ₹3,00,000 | 5% | NIL |

| ₹3,00,001 – ₹5,00,000 | 5% | 5% |

| ₹5,00,001 – ₹7,00,000 | 20% | 5% |

| ₹7,00,001 – ₹10,00,000 | 20% | 10% |

| Above ₹10,00,000 | 30% | 15%-30% |

Choosing the Right Tax Regime

- New Regime: Ideal if you have minimal deductions or investments.

- Old Regime: Better if you utilise deductions like 80C, HRA, and home loans.

Evaluate both regimes to determine which saves you more tax.

Conclusion

Understanding income tax slabs and recent changes can help you make informed decisions. The revised slabs under the new regime for FY 2024-25 offer simplicity and relief for middle-income taxpayers. Choose wisely to optimise your tax savings!