Struggling with GST Waiver Forms? Here’s What You Need to Know

Taxpayers across India have reported GST waiver issues while filing applications under the special amnesty scheme via forms SPL 01 and SPL 02. With the deadline for tax payments fast approaching, addressing these problems is crucial to avoid penalties and interest.

Here’s a user-friendly breakdown of the challenges, official clarifications, and practical solutions—so you can file stress-free.

🔍 Common GST Waiver Issues and How to Fix Them

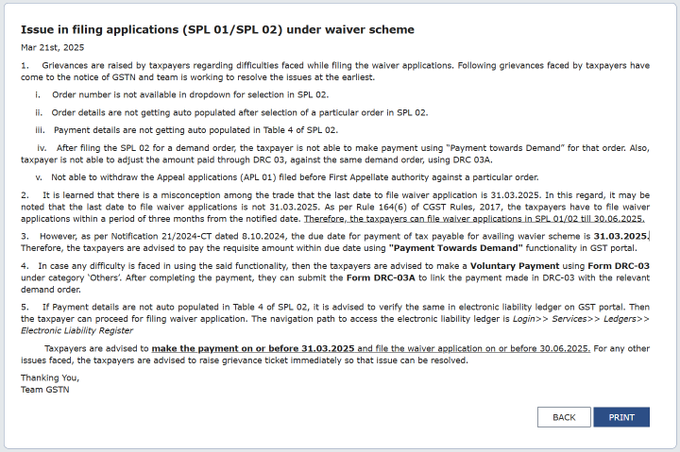

As per updates from the Goods and Services Tax Network (GSTN), the following technical glitches have been reported:

- Missing Order Number in Dropdown:

SPL 02 doesn’t display certain demand order numbers, preventing selection. - Order Details Not Auto-Filling:

Even when an order is selected, details fail to auto-populate in the form. - Payment Info Missing in Table 4 of SPL 02:

Crucial payment details are not visible, causing delays in form submission. - Unable to Pay Using “Payment Towards Demand”:

After SPL 02 submission, many users can’t use this function or adjust payments made via DRC-03 through DRC-03A. - Appeal Withdrawal Glitch:

Taxpayers cannot withdraw appeal applications (APL-01) made before the First Appellate Authority, blocking them from accessing the waiver benefits.

✅ Official Fix: GSTN is actively working to resolve these system errors. Taxpayers are encouraged to raise a grievance ticket via the Self-Service Portal immediately for faster resolution.

📅 Know Your Dates: Avoid Costly Misunderstandings

✅ What’s the Real Deadline?

Many believe March 31, 2025 is the last date to file the waiver application—but that’s only half true.

Clarification from Rule 164(6), CGST Rules 2017:

- Waiver Application Deadline (SPL 01/02): June 30, 2025

- Tax Payment Deadline to Avail Waiver: March 31, 2025

(Notification No. 21/2024 – Central Tax, dated 08.10.2024)

🧾 What to Do If GST Payment Options Fail?

If you’re unable to pay using the designated “Payment Towards Demand” feature:

- Make a Voluntary Payment through Form DRC-03 under the category “Others”.

- Then, link the payment with the relevant demand order using Form DRC-03A.

💡 Tip: Always verify payment records in the Electronic Liability Ledger.

Path: Login → Services → Ledgers → Electronic Liability Register

🧠 Expert Insight: Why This Matters

Delays or technical errors in availing amnesty schemes can lead to:

- Missed Waivers

- Hefty Interest and Penalties

- Legal Challenges

🔎 A 2022 Supreme Court ruling in Bharti Airtel Ltd. v. Union of India emphasized the importance of taxpayer access to error-free portals and ruled in favor of rectification rights in cases of systemic glitches.

💡 Key Takeaways for Business Owners & Professionals

- Don’t wait for glitches to auto-resolve—use Form DRC-03 as a workaround.

- Ensure payment is made by March 31, 2025 to benefit from the waiver.

- File your waiver application before June 30, 2025, even if payment is already done.

- Track your liabilities and grievances regularly on the GST portal.

- Follow trusted sources like GSTN, CBIC, and Efiletax for reliable updates.

🔁 Repurposing Strategy

For Tweet Thread or LinkedIn Post:

❗ Facing issues with GST waiver forms SPL 01/02?

✅ Here’s what to know: 🗓 Pay by 31 Mar 2025

📄 File by 30 Jun 2025

🧾 Use DRC-03 if payment fails

🚨 Common glitches explained (1/5)…

For Infographic:

- Timeline: Payment vs Application Due Dates

- Top 5 Glitches

- DRC-03 + DRC-03A Flowchart

- Ledger Navigation Steps

❓FAQs – Based on “People Also Ask” on Google

Q1: What is the last date to apply for the GST waiver scheme in 2025?

A: The waiver application can be filed till 30th June 2025, but tax must be paid by 31st March 2025.

Q2: How to make payment if “Payment Towards Demand” fails?

A: Use Form DRC-03 and later link it using Form DRC-03A.

Q3: What to do if SPL 02 form doesn’t auto-populate order details?

A: Check your Electronic Liability Ledger and raise a grievance ticket.

Q4: Can I file a waiver if I’ve already appealed the order?

A: You must withdraw the appeal (APL-01) first. If unable, raise a support request.