Capital Gains Exemption Under Section 54F: A Comprehensive Guide

Section 54F of the Income Tax Act provides a valuable exemption for taxpayers who reinvest their long-term capital gains in a residential property. Here’s everything you need to know to make the most of this tax-saving provision.

1. Eligibility for Exemption

- This exemption is available to individuals and Hindu Undivided Families (HUFs).

- The long-term capital gain should arise from the sale of assets other than residential property.

2. Conditions to Claim Exemption

To avail of the benefits under Section 54F:

- Purchase: The taxpayer must purchase a new house:

- Within 1 year before or 2 years after the sale of the original asset.

- Construction: Alternatively, the taxpayer can construct a residential house within 3 years from the date of transfer of the original asset.

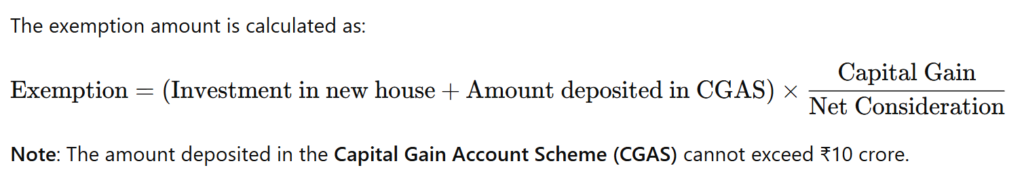

3. Maximum Exemption Calculation

Note: The amount deposited in the Capital Gain Account Scheme (CGAS) cannot exceed ₹10 crore.

4. Understanding CGAS (Capital Gain Account Scheme)

- If the capital gains are not utilized for purchasing or constructing a house before filing the income tax return, the funds must be deposited in a Capital Gain Account Scheme (CGAS) with a bank.

- The deposited amount can later be used for the intended purpose.

5. Denial of Exemption

The exemption will be denied if:

- The taxpayer already owns more than one residential property at the time of transferring the original asset.

- The taxpayer fails to comply with the reinvestment timelines.

6. Withdrawal of Exemption

Exemption is withdrawn under the following conditions:

- The new house is not purchased or constructed within the specified time frame:

- 2 years for a purchased house.

- 3 years for a constructed house.

- The new house is transferred within 3 years from the date of purchase or completion of construction.

7. Key Takeaways

- The exemption under Section 54F is designed to promote investment in residential property.

- Taxpayers should plan their reinvestments carefully, especially if they intend to utilize CGAS.

- Compliance with timeframes and ownership conditions is critical to retain the exemption.

Frequently Asked Questions

Q1: What happens if I don’t use the capital gains for purchasing or constructing a new house?

You must deposit the amount in a Capital Gain Account Scheme (CGAS) before filing your income tax return.

Q2: Can I claim this exemption if I already own more than one house?

No, taxpayers owning more than one residential property at the time of sale are ineligible for the exemption.

Q3: Can the exemption be withdrawn later?

Yes, if the new house is not purchased or constructed within the specified period or if it is transferred within 3 years, the exemption will be revoked.

Need help with your capital gains tax planning? Visit efiletax for simplified guides and professional tax services tailored to your needs.