Advisory for Form GST DRC-03A: Simplifying Payment Adjustments

Published on: November 5th, 2024

Handling Goods and Services Tax (GST) compliance can sometimes become a complex affair, especially when it comes to adjusting payments against demand orders. To simplify this process, the GST department has introduced Form GST DRC-03A to link payments made through Form GST DRC-03 against specific demand orders, ensuring transparency and preventing discrepancies. Here’s everything you need to know about the new form and how to use it effectively.

Understanding Form GST DRC-03A

Form GST DRC-03A was notified under Notification No. 12/2024 dated July 10th, 2024, and aims to address issues arising when taxpayers incorrectly use Form GST DRC-03 instead of the “Payment Towards Demand” facility available on the GST portal. This incorrect usage led to situations where taxpayers paid their outstanding demands but failed to close them in the electronic liability register.

The introduction of Form GST DRC-03A ensures that payments made through DRC-03 are correctly matched and linked to the corresponding demand order, closing the demand in the register and updating the liability status.

How to File GST DRC-03A?

Taxpayers can use Form GST DRC-03A for cases where payment through Form GST DRC-03 was made under the categories “Voluntary” or “Others”. The following steps guide you through the process of filing the form:

- Access the Form: Go to the GST portal and select the option for Form GST DRC-03A.

- Enter ARN and Demand Order Number: Taxpayers need to input the Application Reference Number (ARN) of Form GST DRC-03 and select the appropriate demand order number.

- Automatic Population of Details: The system will then auto-populate details from both Form GST DRC-03 and the corresponding demand order.

- Adjustment of Paid Amount: Taxpayers can adjust the paid amount either partially or fully against the outstanding demand.

- Liability Ledger Update: Once the adjustment is complete, entries will be automatically updated in the taxpayer’s liability ledger, reflecting the status of demand closure.

Key Scenarios for Using Form GST DRC-03A

- Multiple Payments: If multiple Form GST DRC-03s are being adjusted against a single demand order, a separate Form GST DRC-03A must be filed for each DRC-03.

- Partial Adjustment: Taxpayers have the flexibility to adjust payments partially against one or more demand orders using Form GST DRC-03A.

- Demand Orders Covered: The form can be used to adjust outstanding demand orders raised through DRC-07, DRC-08, MOV-09, MOV-11, or APL-04.

Frequently Asked Questions (FAQs)

Q1: What is Form GST DRC-03A?

A1: It is a form introduced to help taxpayers adjust payments made through Form GST DRC-03 against pending demands in the electronic liability register.

Q2: Who can file Form GST DRC-03A?

A2: Taxpayers who have payments through DRC-03 for any demand raised under DRC-07, DRC-08, MOV-09, MOV-11, or APL-04 can file this form.

Q3: Can multiple DRC-03 payments be adjusted against a single demand order?

A3: Yes, but separate Form GST DRC-03A needs to be filed for each DRC-03.

New Updates and Case Laws

The introduction of GST DRC-03A was a result of several concerns raised by taxpayers and clarified in recent rulings. In a Madhya Pradesh High Court judgment (case reference: XYZ vs. GST Department, 2024), it was highlighted that failure to properly link payments using existing forms led to undue penalties and legal complexities. The court’s direction was instrumental in ensuring the process is simplified for taxpayers by automating the linking mechanism.

This update aims to eliminate any manual errors in demand adjustments, reduce administrative burdens, and protect the rights of taxpayers who have already fulfilled their financial obligations.

Practical Example: Linking Payments

Imagine a taxpayer, Ramesh, received a demand order under Form DRC-08 for an additional liability of ₹50,000. Ramesh made a voluntary payment through Form GST DRC-03, but without linking it properly to the demand order, the liability continued to reflect as outstanding. With Form GST DRC-03A, Ramesh can now enter the ARN of the payment made and link it directly to the demand, thus resolving the issue and ensuring his ledger reflects zero dues.

Technical Support and Detailed Advisory

In case of any technical issues while filing Form GST DRC-03A, taxpayers can raise a ticket on the Grievance Redressal Portal under the category “DRC-03A-Filing”. Additionally, the GST portal has provided a Detailed Advisory and FAQs to guide taxpayers through the entire process seamlessly. You can access the advisory here.

Conclusion

The introduction of Form GST DRC-03A is a step towards making GST compliance smoother and eliminating discrepancies in payment adjustments. Taxpayers are encouraged to use this form to ensure their payments are properly linked and demands are closed without unnecessary delays.

For more details and support, always refer to the updated FAQs and advisories available on the GST portal.

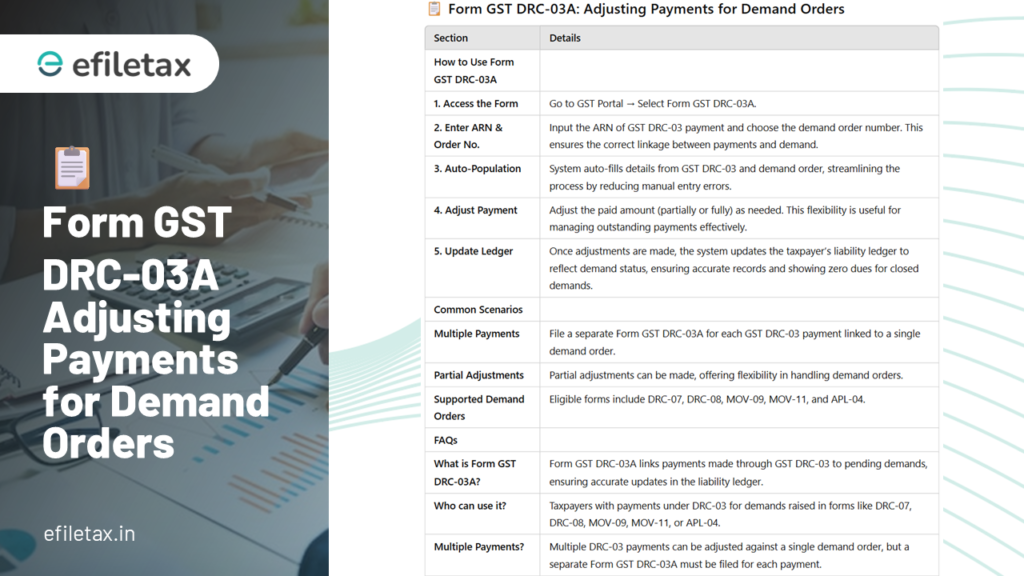

📋 Form GST DRC-03A: Adjusting Payments for Demand Orders

| Step | Action | Explanation |

|---|---|---|

| Access the Form | Go to GST Portal → Select Form GST DRC-03A | Find the form to initiate the linking process. |

| Enter ARN & Order Number | Input the ARN of GST DRC-03 payment & choose the demand order number | Ensures the correct linkage between payments and demand. |

| Auto-Population | System auto-fills details from GST DRC-03 and demand order | Streamlines the process by eliminating manual entry errors. |

| Adjust Payment | Adjust the paid amount (partially or fully) | Provides flexibility in managing outstanding payments. |

| Update Ledger | System updates taxpayer’s liability ledger with demand status | Ensures accurate records and reflects zero dues for closed demands. |

Key Scenarios for Form GST DRC-03A

| Scenario | Details |

|---|---|

| Multiple Payments | File a separate Form GST DRC-03A for each GST DRC-03 payment linked to a single demand order. |

| Partial Adjustments | Adjustments can be made partially, allowing for flexibility across demand orders. |

| Supported Demand Orders | DRC-07, DRC-08, MOV-09, MOV-11, and APL-04 demand orders are eligible for adjustments via Form GST DRC-03A. |

Common Questions (FAQs)

| Question | Answer |

|---|---|

| What is Form GST DRC-03A? | It’s a form for linking payments made through GST DRC-03 to pending demands, ensuring updates in the liability ledger. |

| Who can use Form GST DRC-03A? | Taxpayers who made payments under DRC-03 for demands raised in forms like DRC-07, DRC-08, MOV-09, MOV-11, or APL-04. |

| Can multiple DRC-03 payments be adjusted together? | Yes, but you must file a separate Form GST DRC-03A for each payment. |

Practical Example

Scenario: Ramesh received a demand order (DRC-08) for an additional liability of ₹50,000. After paying voluntarily through GST DRC-03, his ledger still showed an outstanding amount due to incorrect linkage. With Form GST DRC-03A, Ramesh enters the ARN and links it to his demand order, ensuring his ledger reflects zero dues.